How to Earn 10 Million Dollars

Test question:

You have an employee whose job is to produce boxes. However, this job is not as easy as it sounds. He (the hypothetical employee is usually male, for some reason) sits in a room with all types of materials of varying size and shape, but is still responsible for creating boxes of a uniform size and shape. This job requires both creativity and hard work. You decide to reward this employee with a weekly salary, after you have a chance to evaluate how many boxes he makes (although there are other factors, like how he gets along with others and how much material he wastes, but you are primarily interested in direct output). You give the employee $50 a week, and he produces 50 boxes. "Alright," you say, "Let's pay him $100 a week," and promptly your employee produces 54 boxes. Okay, that's a little off, but you increase his pay to $200 a week (these boxes are very profitable) - and the next week your employee makes 35 boxes. What is going on here? You decide to scale back his pay to $40 a week, and now he makes 61 boxes. That seemed to work, so you try paying him $35 a week and now you get 71 boxes.

Here's the question: What is a fair wage for this employee?

The correct answer is, apparently, $10 million.

This is the point at which you sigh inwardly, realizing you're reading yet another editorial about the evils of executive compensation. Take heart, gentle reader, my goal is not to shock or to anger, but to provide remedies and hopefully teach by example.

In March, USA Today released a compilation of the CEO pay for 150 of the S&P 500 companies, and found a median compensation of $9.6M, with a mean of $10.9M. Of course this led to the inevitable cavalcade of critics crying foul, but I was interested in a separate question - did they earn that money?

As most defenders of executive compensation could explain, the gains that a successful CEO can make for a large company are enormous. A 4% increase in stock price could be worth hundreds of millions, and so paying a third of that to someone so responsible for that growth only makes sense.

This argument is odd though, as we generally do not pay employees a percentage according to the yearly profitability of the company, otherwise every worker at Tech Data would be making over a million a year, and the employees at Superconducter Technologies would sadly only be making about $15,000 annually.

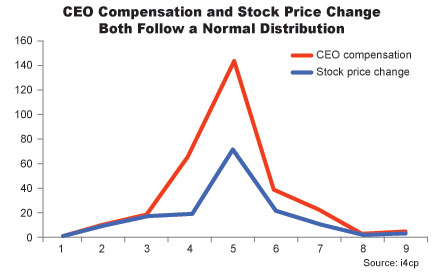

Generally, we pay people based on past or expected performance, with a baseline dependent on rarity of the skill set. Since there is some interesting data that suggests performance might not always fall along a true bell curve, the first step is to check to see if company performance is normally distributed - that is, are the majority of companies within one standard deviation of the average? With the data provided, and only examining the stock price change for the 150 or so companies that both reported CEO compensation data and had the same CEO all of last year, I first looked to see if company performance is normally distributed, which it is. Then I looked to see if CEO pay was normally distributed, and that too was fairly bell-curved.

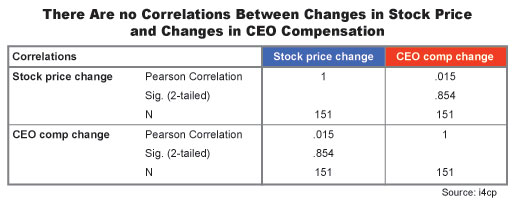

Where it gets weird is not the percentage, or even the amount that CEOs are making, it's that their pay and company performance are not linked. i4cp's researchers took the S&P 500 data and looked at it another way - we ran a correlation of CEO pay to company performance, and found the following:

What you are seeing is the dreaded

SPSS output table sans

asterisks,

which is to say, there is no correlation. Higher paid CEOs are not

necessarily those whose stock price went up last year.

The counter-argument to this is that CEOs are often paid according to

how large the company is. The CEO at Boeing is naturally going to make

more than the CEO of International Flavors and Fragrances. Usefully,

the data also shows the percent change in compensation from 2010. So,

I checked to see if there was any correlation between compensation

increases in the last year and company performance. Again, no.

This is even more surprising when you consider that a significant percentage of the average CEO's pay is in the form of stock options. This anomaly is explainable by another component of CEO compensation, which are bonuses given for hitting some particular goal (cf. debt reduction, safety, cost management).

We aren't the only ones who have failed to show a correlation between CEO pay and company performance - in a paper out this month, The Manchester School found the same lack of relation in Norway.

With all that said, this is not a treatise calling for a reform of CEO compensation; that's been done many times before.

Nor would we say the position of CEO is meaningless, because CEOs can have an effect on corporate performance. The point is that many CEOs aren't aligned with business objectives. Their compensation isn't aligned in a meaningful way with the outcomes they are meant to influence, so their financial results are independent of the performance of the companies they work for. Note that this can work both ways - there are examples on the list of CEOs who made much less than last year, even though their company's stock value went up.

If not curtailed, CEO compensation will continue on its untenable path due to leapfrogging and basic human greed. The first step in halting this phenomenon is doing a better job analyzing CEO performance, and rewarding accordingly. The second is to steer clear of benchmarking CEO pay, and avoiding outside hiring firms.

Even if you aren't in a position to influence CEO compensation at your organization, this is a prominent example of methodology and perspective. Such a strong disconnect between outcomes and rewards would not fly for anyone else in the workplace, and is a glaring reminder of why we need to focus on outcomes rather than outputs. Employees should be performing activities that influence the business (hopefully in a positive way), and we should find data that accurately measures that influence so that employees can be evaluated and compensated based upon their actual performance.

After all, these boxes aren't going to make themselves.

Cliff Stevenson is a senior researcher at i4cp, and believes his CEO is compensated correctly, maybe even a little underpaid.